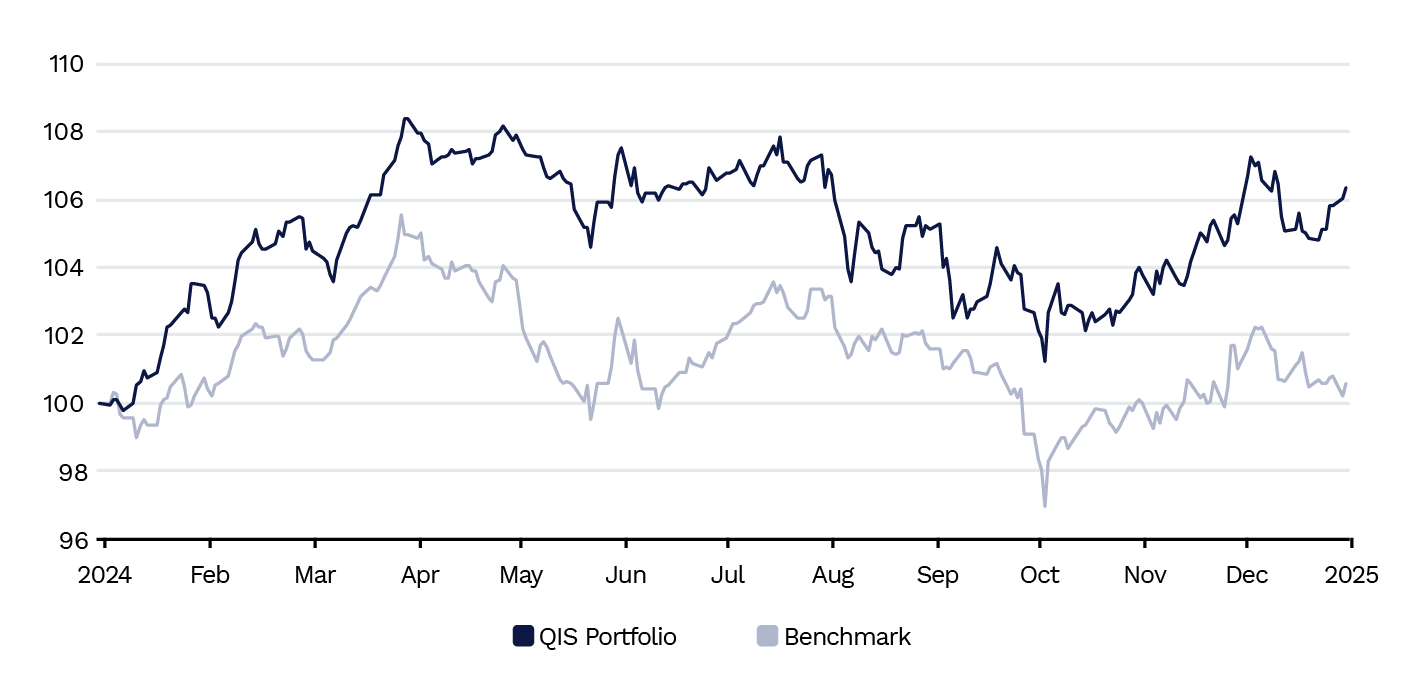

In the competitive QIS investment landscape, understanding the value contributed by each stage of the investment process is essential. Premialab’s latest research presents a performance-attribution framework that precisely identifies the sources of performance differences between a portfolio of Quantitative Investment Strategies (QIS) and its benchmark.

Tailored to the specific characteristics of QIS investments, the methodology measures the value added by each investment decision and answers key questions such as:

- How much excess return was generated by style allocation?

- Were the right styles overweighted through tactical adjustments?

- Were the selected strategies the most effective implementations of the underlying factors?

The framework enables managers to objectively identify weak links and strengthen the most effective components of their investment process. Read the article to uncover the full insights.