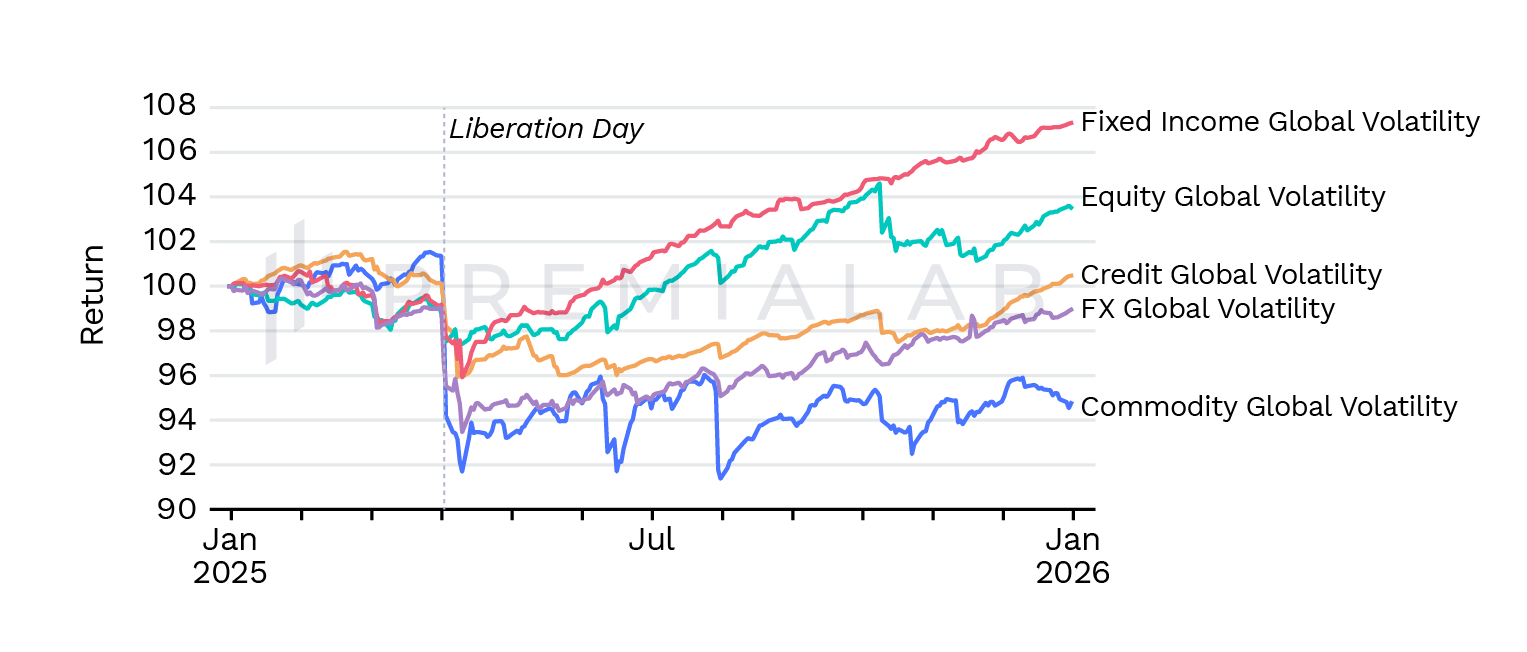

2025 was defined less by surprise and more by persistence. A sustained risk-on regime, easing financial conditions, and declining volatility created a powerful tailwind for equity-centric risk premia, while systematically eroding the value of defensiveness and convexity. Equity Value and Momentum emerged as the clearest beneficiaries of this environment, particularly in Europe, supported by broadening leadership and elevated dispersion. In contrast, commodities, long volatility, and cross-asset trend factors struggled in the absence of sustained macro stress or directional persistence. The year highlighted that strong absolute returns can coexist with weakened diversification, reinforcing the importance of regime awareness, factor interaction, and dynamic exposure management in portfolio construction.