When financial markets are characterized by rapid fluctuations and unprecedented complexity, innovation in Quantitative Investment Strategies (QIS) has become essential for investors striving to maintain a competitive edge. The ability to react quickly to market changes is no longer just an advantage; it is a necessity. This urgency is particularly evident in the realm of short-term volatility carry indices, which are increasingly being used to capture a reliable source of alpha.

Short-term volatility carry indices are designed to monetize the premium generated by the sale of options while limiting exposure against sudden price movements more effectively compared to traditional implementations. This article will delve into the significance of innovative implementations, highlighting how they empower investors to harness speed and precision in their investment approaches.

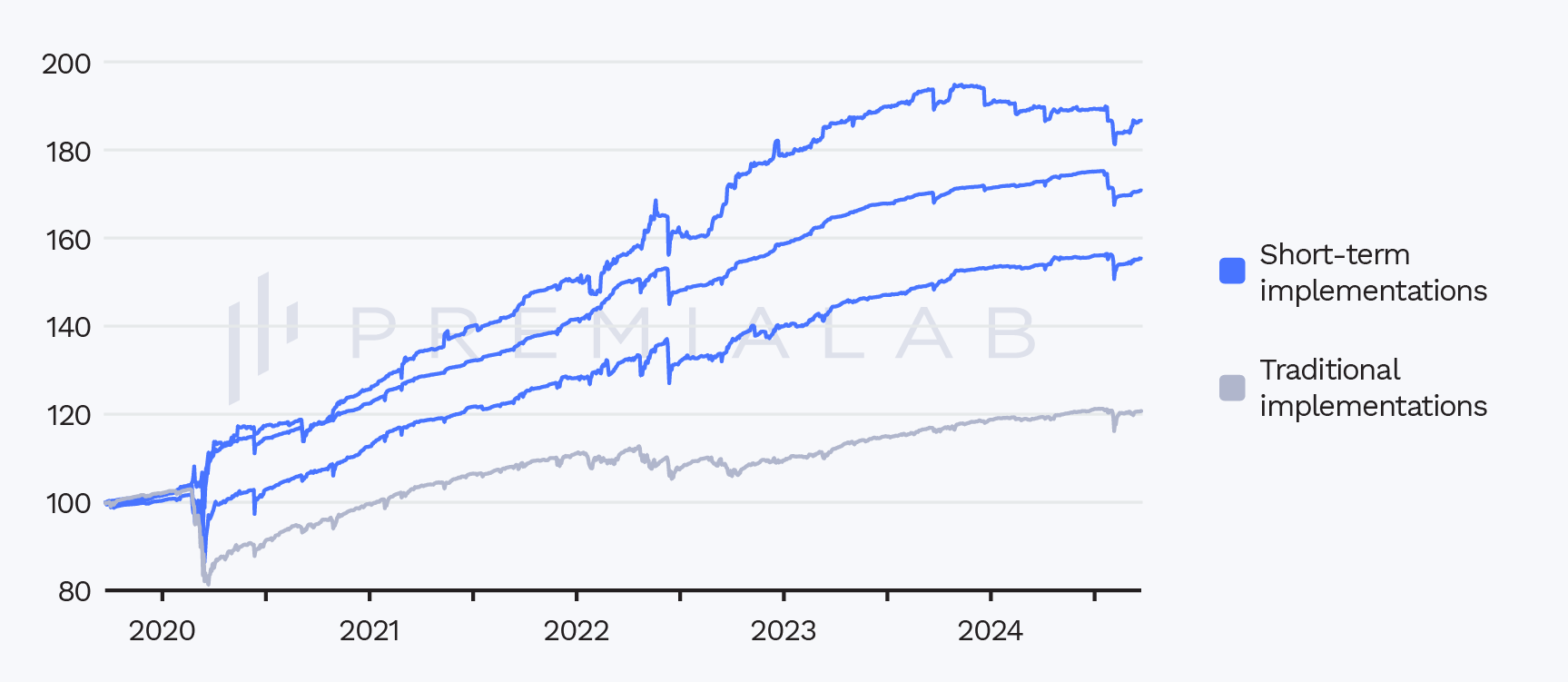

Performance of short-term vs. traditional implementations of short volatility strategies